I got into the paint business

I got into the paint business last week! Sherwin-Williams (SHW) is a 150 year old company selling paints and coatings. I first got interested in Sherwin-Williams 9 months ago, and have been watching the stock since.

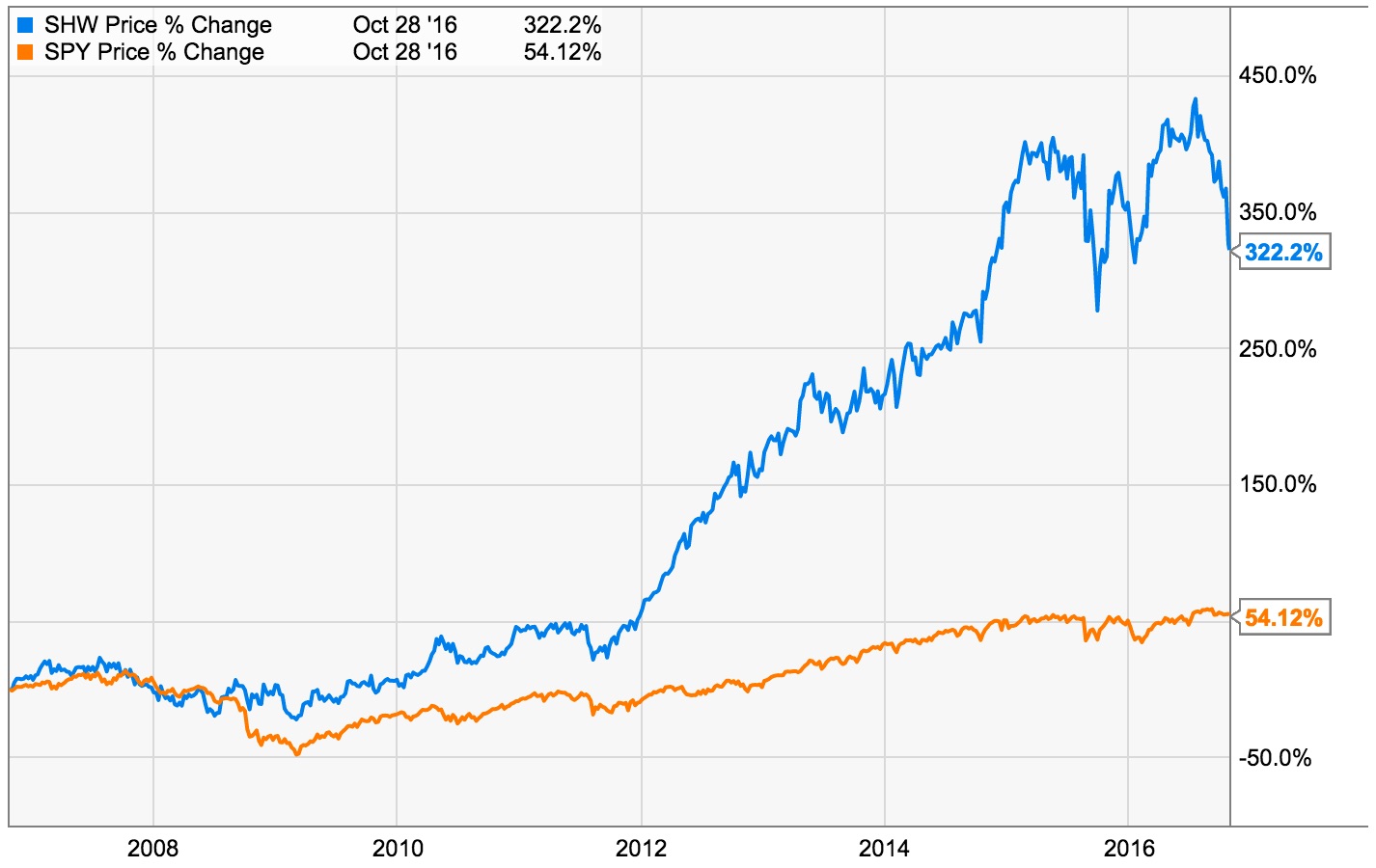

A business selling paint sounds boring, but Sherwin-Williams might have one of the best business models in the world. The reason for my interest is that over the past 10 years Sherwin-Williams' annualized return was 17%. Put differently, someone who invested $10,000 in Sherwin-Williams 10 years ago, would have seen that money grow to $50,000 today. The past 20 years, between 1995 and 2016, Sherwin-Williams returned on average 15% per year and the past 30 years, between 1985 and 2016, Sherwin-Williams returned on average 15% per year as well. In other words, if you invested $10,000 in Sherwin-Williams 30 years ago, it would have grown to be over $700,000 today. When it comes to investing, boring can be good. People will always paint things, in good times and bad times, and they don't mind paying extra for quality.

Past performance is no guarantee for future results. I've been waiting to invest in Sherwin-Williams for about 9 months, and finally started half a position last week at $249 a share. The share price of Sherwin-Williams declined by about 21% from its all-time high, in part because of a disappointing third-quarter earnings report. At $249, Sherwin-Williams might not be a screaming buy – the P/E of 21 remains relatively high. If you're a more patient investor, it might be worth waiting a bit longer. The price could fall further, especially if the Federal Trade Commission blocks the Valspar acquisition or if the market corrects more broadly. At the same time, there is no guarantee the stock will go lower and Sherwin-Williams might not trade 21% of its all-time high for long. If the stock were to drop another 10% or more, I would almost certainly buy more and cost-average into a full position.

Understanding past returns

The first thing I like to do is study how a company achieved such returns.

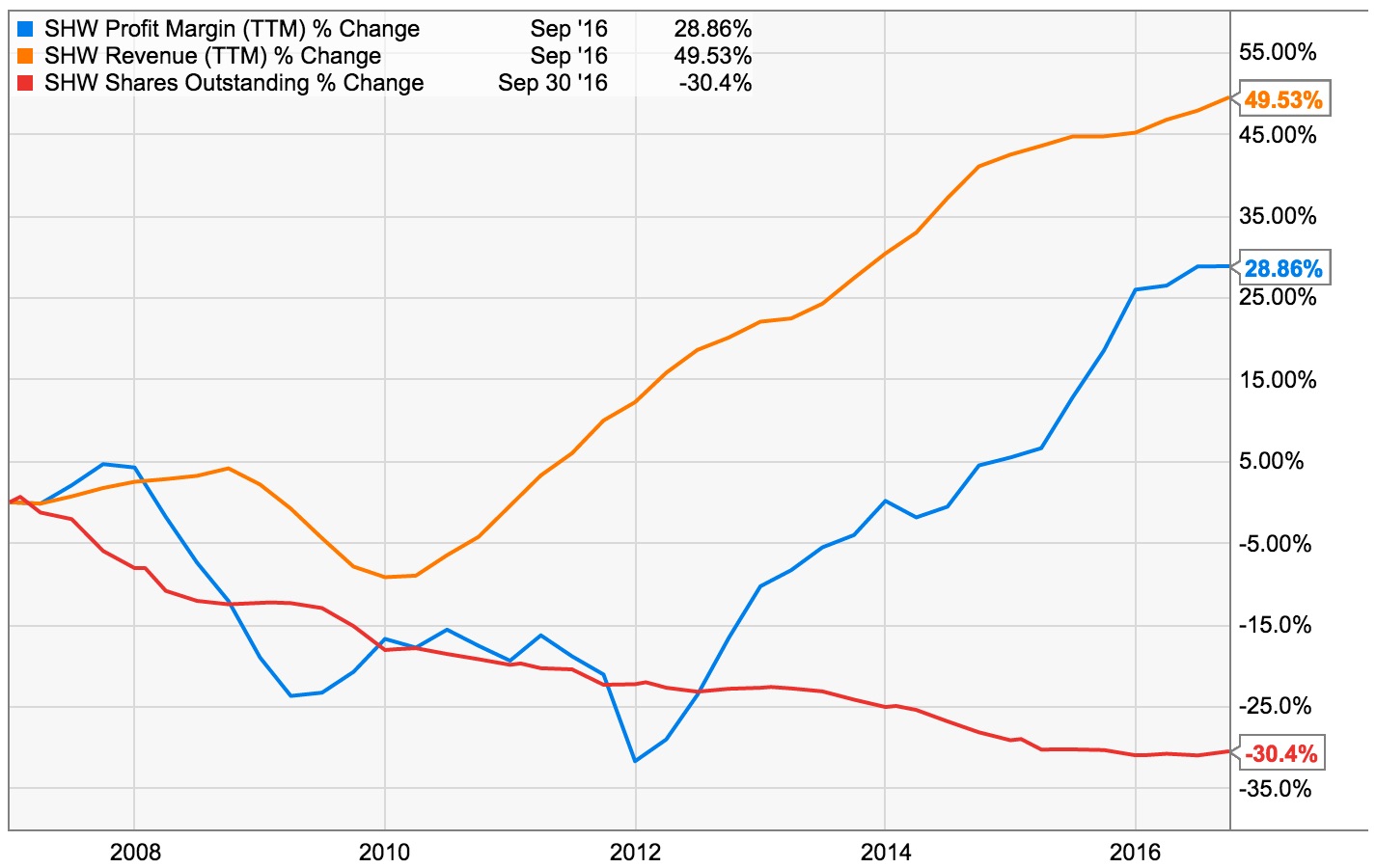

Between 2006 and 2016, Sherwin-Williams grew revenues 4% annually from 7.8 billion to 11.7 billion. Earnings grew faster than revenues as the result of profit margins improving from 7.4% to 9.5%. Specifically, earnings grew 6.8% annually from 576 million in 2006 to 1.1 billion in 2016.

Earnings growth of 6.8% isn't something to write home about. Fortunately, earnings growth isn't the whole story. What makes Sherwin-Williams an interesting business is that it gushes cash flow to the tune of 1.1 billion a year on 11.7 billion of sales. The company used its cash flow to buy back 31% of its shares between 2006 and 2016. This has allowed earnings per share to grow by an additional 3.8% annually.

Next we can add in the dividend. Sherwin-Williams has a history of raising its dividend for 38 years. The past 10 years, Sherwin-Williams had an average dividend yield of 1.6%.

So we have 6.8% earnings per share growth as the result of growing sales and margin expansion, and 3.8% earnings per share growth thanks to a reduction in share count. This equates to 10.6% earnings per share growth. Add a 1.6% dividend yield, and investors are looking at 12.2% annual returns. That is a great return, especially for a 150 old business selling paint.

In addition to revenue growth, margin expansion, a significant share count reduction and a small dividend, Sherwin-Williams also saw significant price to earnings (P/E) expansion. In 2006, Sherwin-Williams was trading at a P/E of 14 while it is trading at a P/E of 21 today. On average, the P/E expanded by 4.1% per year. While some of the P/E expansion could be justified by the quality of the sales improving (higher margins), it is fair to say that the P/E got ahead of itself.

Modeling future returns

The second thing I like to do is evaluate a company's future prospects.

The reason Sherwin-Williams has been so successful over the past decade is because it had all these components working together – sales growth, margin expansion, share count reduction, a small dividend and a growing valuation. Understanding the different components is important to help us evaluate Sherwin-Williams' prospects.

Because of Sherwin-Williams' healthy cash flow, I believe the company should be able to keep growing revenues (through acquisitions), keep retiring shares, and grow their dividend for the foreseeable future. I'm more concerned about the margins and valuation components. Sherwin-Williams won't be able to improve margins forever – in fact, an increase in input costs could have negative impact on margins. And despite a 22% drop in price and growing earnings, the P/E remains high at 21.

For illustration purposes, let's assume that Sherwin-Williams' earning per share will grow 6% for the next 5 years instead of the 10.6% it grew the last decade. After five years, earnings per share would grow from $11.16 in 2015 to roughly $14.9 in 2020. Next, let's factor in the possibility for a P/E contraction. Let's say that after five years, the P/E contracted almost 30% from 21 to 15. In this scenario, shares of Sherwin-Williams would be trading at $224 in 2020. This is $20 below today's share price of $244. That said, the next 5 years a shareholder of Sherwin-Williams will collect something in the order of $25 in dividends for every share owned. This would bring the total return up to $249. I consider this scenario to be pessimistic but certainly in the realm of possibilities.

In a more optimistic scenario, Sherwin-Williams might be able to maintain a 10% earnings per share growth rate at a P/E of 18. Here, we're looking at a 2020 share price of $323, good for an annual compound growth rate of almost 6%.

Needless to say, this is a very rough model. The idea is not to create a perfect model, but to understand a range of possibilities.

Long-term passive income

While I don't think I will lose money on my investment, I also don't expect that Sherwin-Williams will be a home run in the next 5 years. Why then did I decide to invest? The reason is that I prefer to think in terms of decades, rather than a 5 year horizon. What excites me about Sherwin-Williams is not its prospects over the next 5 years, but its potential for income generation 20 to 30 years from now.

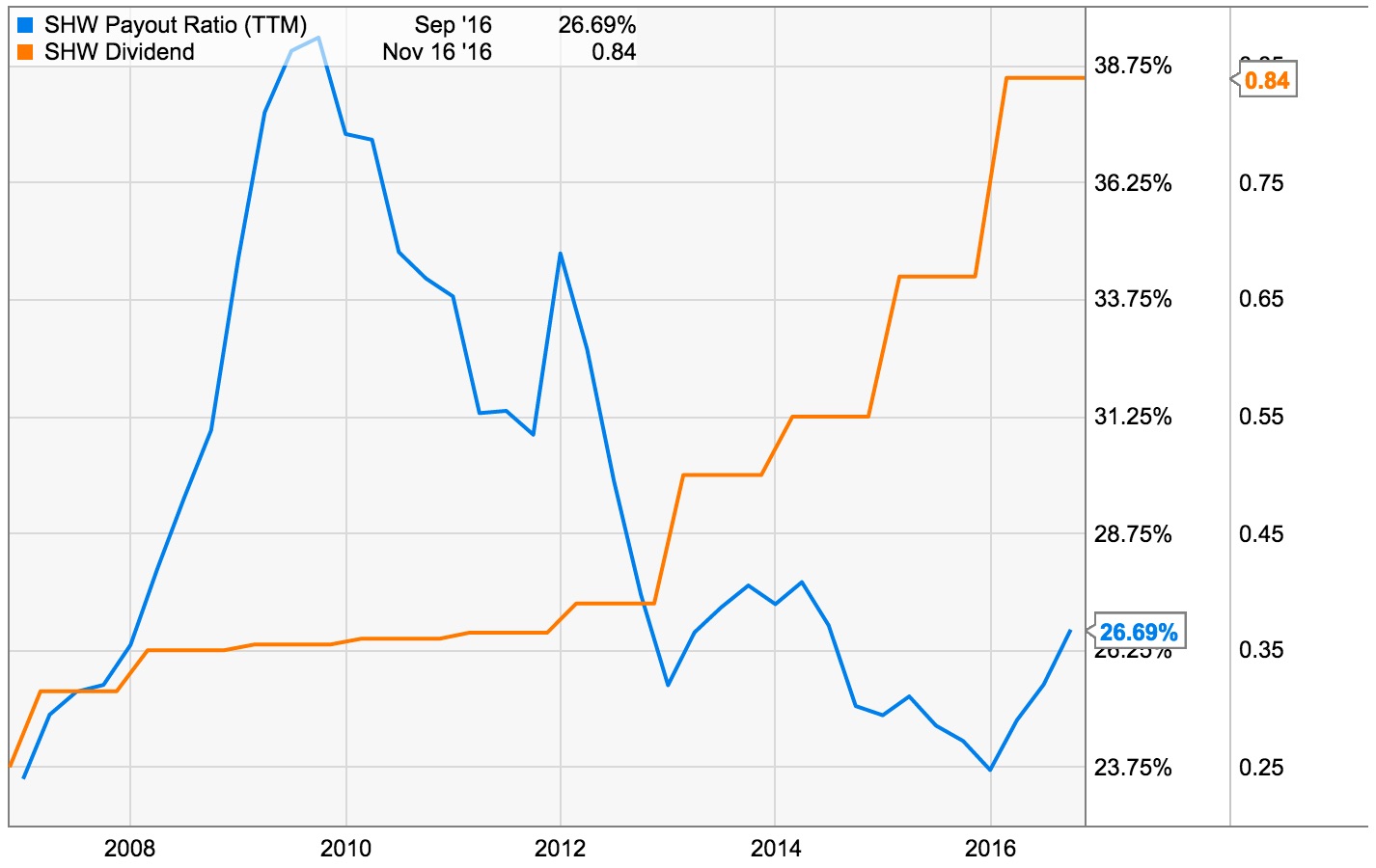

Sherwin-Williams appears to be a well-run company. It has been in business for 150 years and continues to grow at a healthy pace. It has increased dividends each year for the last 38 years. During the past 10 years, the dividend growth rate was almost 13% annually, well above the S&P 500's 10 year average of 4%. Last week Sherwin-Williams announced a 25% increase in its quarterly dividend from $0.67 a share to $0.84. Even with that generous increase, the company's payout ratio – the percentage of profits it spends on paying out its dividend – remains low at around 30%.

Sherwin-Williams's starting dividend of 1.3% is not impressive, but its dividend growth rate is. Should Sherwin-Williams continue to increase its dividend by 13% annually, after 20 years, each share would produce $39 in annual income. After 30 years the annual dividend would amount to $132 per share. The yield on cost would be 16% and 54% respectively. Given the low payout ratio, strong share buyback program, and the 30 year track record of 15%+ returns, I believe that could be a possibility. Time will tell. If you plan to hold Sherwin-Williams for 20 to 30 years, I believe it could be among the best stocks for both wealth building and dividend income.

Disclaimer: I'm long SHW with a cost basis of $249 per share. Before making an investments, you should do your own proper due diligence. Any material in this article should be considered general information, and not a formal investment recommendation.

—