How much money to raise for your startup? [Flowchart]

From time to time, people ask me how much money to raise for their startup. I've heard other people answer that question from "never raise money" to "as little as you need" to "as much as you can".

The reason the answers vary so much is because what is best for the entrepreneur is seemingly at odds with what is best for the business. For the entrepreneur, the answer can be as little as necessary to avoid dilution or giving up control. For the business, more money can increase its chances of success. I feel the right answer is somewhere in the middle – focus on raising enough money, so the company can succeed, but make sure you still feel good about how much control or ownership you have.

But even "somewhere in the middle" is a big spectrum. What makes this so difficult is that it is all relative to your personal risk profile, the quality of the investors you're attracting, the market conditions, the size of the opportunity, and more. There are a lot of parameters to balance.

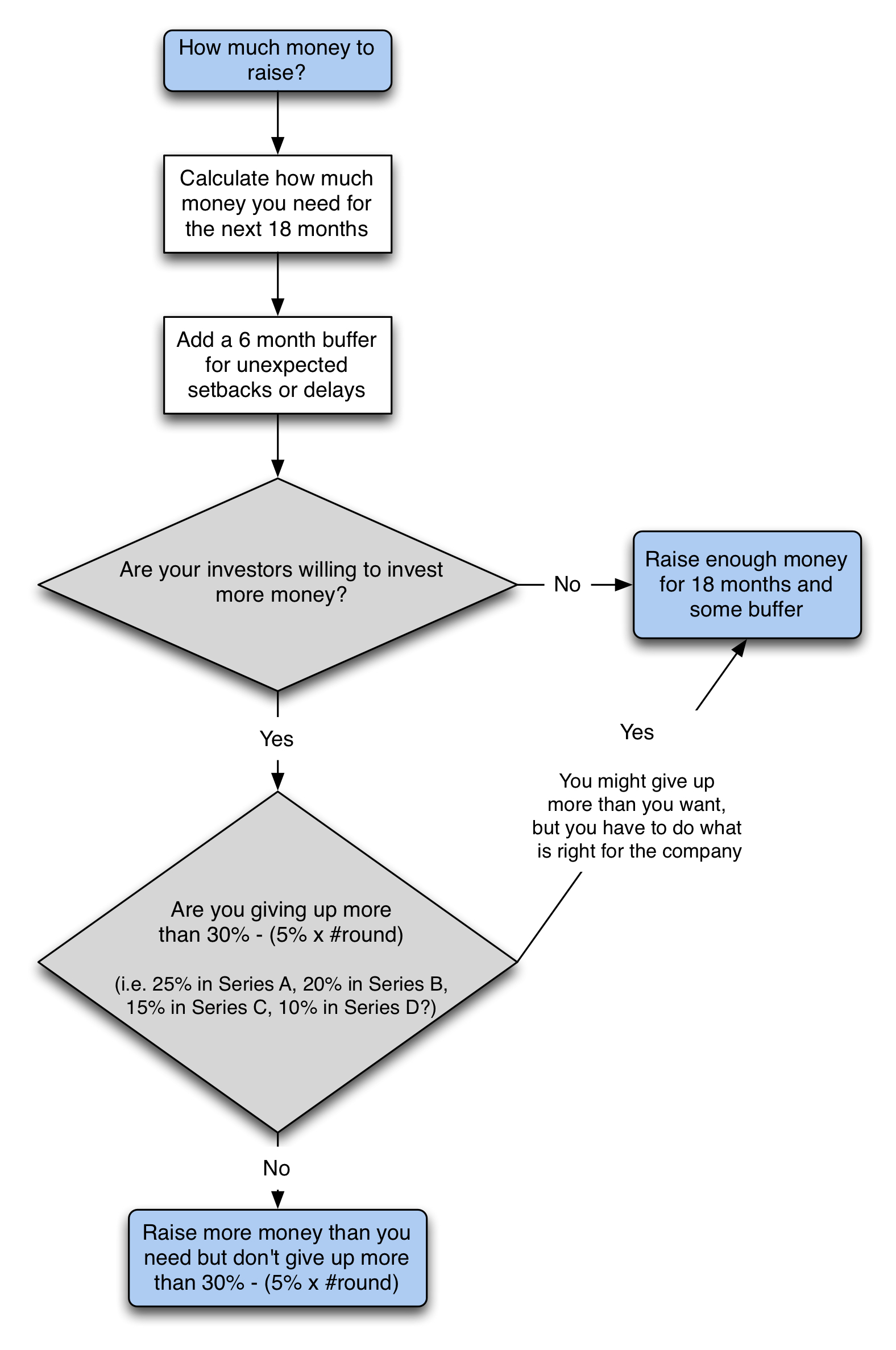

I created the flowchart below (full-size image) to help you answer the question. This flowchart is only a framework – it can't take into account all decision-making parameters. The larger the opportunity and the better the investors, they more I'd be willing to give up. It's better to have a small part of something big, than to have a big part of something small.

Some extra details about the flowchart:

- In general, it is good to have 18 months of runway. It gives you enough time to figure out how to get your company to the next level, but still keeps the pressure on.

- Add 6 months of buffer to handle unexpected bumps or budgeting oversights.

- If more money is available, I'd take it as long you don't give away too much of your company. As a starting point for how much control to give up, I use the following formula: 30% - (5% x number of the round). So if you are raising your series A (round 1), don't give away more than 25% (30 - (5 x 1)). If you are raising your series B (round 2), don't give away more than 20% (30 - (5 x 2)). If you start with 50% of the shares, using this formula, you'll still have roughly 20% of the company after 5 rounds (depending on other dilutive events such as option pool increases).

My view is that of an entrepreneur having raised over $120 million for one startup. If you're interested in an investor's view that has funded many startups, check out Michael Skok's post. Michael Skok is Acquia's lead investor and one of Acquia's Board of Directors. We both tried to answer the question from our own unique viewpoint.

—